01/08/2023

The new alcohol tax – we spoke to women in the drinks industry about what it means

What is the new alcohol tax that comes into force on 1st August 2023?

The Government classes alcoholic drinks into four categories; beer, cider & perry, wine & wine-made, and spirits.

Up until 1st August 2023, beers and spirits were taxed according to their alcoholic strength, while cider & perry and wine & wine-made products were taxed based on the total volume of the product.

The new tax will see the system change. Broadly this means the stronger the alcohol, the higher the tax.

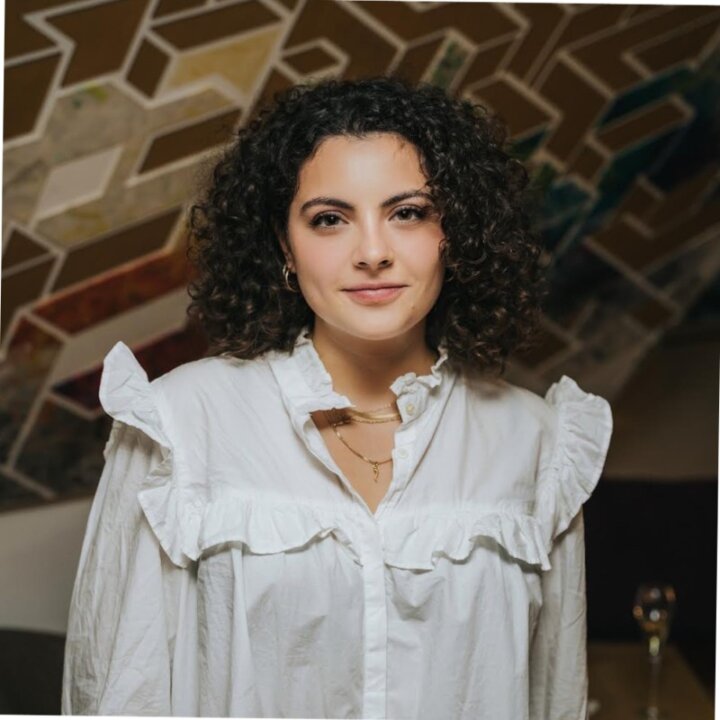

“I think it’s utterly bonkers and clearly decided by people who really don’t understand the alcohol industry” said Helena Nicklin, drinks writer and broadcaster (pictured above). “Why are they demonizing certain drinks and not others? Especially when there is so much tradition and heritage attached to a lot of those. It’s going to undo so much of the work that drinks communicators have done over the years to try to get people to drink less and drink better, and try more interesting things It will get producers to feel obliged to try to do unnatural things to lower ABVs. It will lead to a terrible shift in quality. This is not how you should be thinking about alcohol. It’s such a shame.”

With Chancellor, Jeremy Hunt, promising to support the pub industry, the Government will launch a “draught relief”. Any drinks which contain less than 8.5 ABV, including beers and ciders will see their tax rates reduced.

The Office for Budget Responsibility is estimating that the new alcohol tax will raise £13.1 billion in the 2023-2024 financial year.

What price increases will there be?

The price of a bottle of wine with an ABV of more than 12.5 per cent will see a 44p increase, while a bottle of port or vodka could increase by £1.30 and 76p respectively, according to the Wine & Spirits Association (WSTA)

The impending increase has left wine and spirits producers worried about the financial impact they are about to experience.

Zoe Arnold-Bennett, co-owner of Shed One, Ulverston, Cumbria and The Gin Guide Environmental Sustainability Winner, 2020/21/22 & 23, said: “With Brexit and cost of living crisis, this is another nail in the coffin for craft distilleries. We just have to try and continue to absorb all the increased costs, and hope that we can ride the storm.”

“The new duty increases can only damage an industry that is already struggling” said Dawn Davies, Buying Director of Speciality Drinks Group responsible for the UK’s largest online spirits retailers, The Whisky Exchange. “There have been steep price rises already in the sector with costs of glass, freight and goods go up across the board. Add in duty increases to this and you will see sales impacted by an already stretched consumer. Our industry needs support from the government who has done very little over the last five years to protect an industry that has been on its knees several times due to Brexit, Covid and now Taxes”.

Eloise Feilden Senior Staff writer at The Drinks Business wrote

“As part of the duty reform, wine will be taxed incrementally, by 0.5% ABV, between 11.5% and 14.5%. However, these changes will come into play at a later date, on 1 February 2025.

In the meantime, temporary arrangements will be in place for 18 months from 1 August 2023 until 1 February 2025 which will see all wines between 11.5% and 14.5% ABV taxed as if they are 12.5% in strength — a temporary duty increase of £0.44 per 75cl bottle. The Government argues that this has been done to support wine producers and importers in moving to the new method of calculating duty on their products. After 1 February 2025 will be split into sub-categories with differing duty rates.

Producers have argued that the temporary measures unfairly preference higher alcohol wines as those between 11.5% and 12.5% ABV will be taxed at a higher percentage for the time being.

“There are concerns” said Queena Wong founder of Curious Vines & No.12 Drinks Retailing Top 100 Most Influential People in Drinks 2023. “Firstly the complicated new system of taxation will weigh heavily on SMEs having to work out what tax they need to pay. Secondly these rises on top of other economic pressures such as rising prices for glass increase business challenges and add inflationary pressure. The hospitality sector which has already been suffering will have no choice but to pass these costs onto the consumer.”

Kathy Caton, co-founder of Brighton Gin, said: “I don’t resent paying taxes, I just want it to be fair across the board. The stifling duty costs act as a handbrake to growth for businesses like ours. Instead of putting barriers in our way the Government should be promoting and supporting ‘Brand Britain’ and helping what was a booming sector.

This is also incredibly unfair on consumers who should not be facing higher prices for their favourite drink, especially while the cost of living and inflation crises put ever-increasing pressure on household budgets.”

“Sherry has been enjoyed in moderation by British consumers for hundreds of years. But it’s more than that” said Melissa Draycott from Gonzalez Byass “Our company was a joint endeavour between two families – one in the UK and the other in Spain. Our origins can be traced to 1835 when it was founded by Manuel María González Angel and his English agent, Robert Blake Byass.

“As passionate producers we have been working hard to pass on the sectors rich heritage and introduce a new generation to the joys of a beautifully crafted sherry, through its use in lower alcohol cocktails or served alongside food, however the duty rise will create a significant barrier to purchasing this celebration favourite, which has enjoyed a strong role in British culture for centuries.”

What could be going down in price?

Tax on pints, prosecco and other alcoholic beverages has been cut from Tuesday, with certain drinks on draught could now up to 11p cheaper than supermarket equivalents.

A new levy cut, dubbed the Small Producer Relief, also comes into effect on 1st August. This replaces and extends the previous Small Brewers Relief scheme and allows small businesses who produce alcoholic products with an ABV of less than 8.5% to be eligible for reduced rates of alcohol duty on qualifying products.

However, will this decrease be passed on to the consumers? As the cost of living crisis continues to wreck havoc on the food and drinks industry and pubs taking a battering in recent months, has the Small Producer Relief come at the right time and is it far reaching enough?

Emma McClarkin OBE, CEO of the British Beer and Pub Association speaking to Classic FM on the news this morning said “There will be a tax increase for beer overall as a category. We will see the increase in 10.1% in duty on cans and bottle beer, whether it be in venue or in a supermarket. So it’s almost a give and take change that we are seeing”.

Cecile Beaufils is co-founder of Global Ethics Liquor Co Ltd and the gin brand The Spirit of One and said “Unfortunately the small producer relief does not extend to distilleries, so we are seeing over £1 added to our bottles. It’s more challenging than ever for small brands like us”.

What does this mean for the low/no alcohol industry?

The trend for no and low alcohol drinks is clearly on the rise. Low no brands are also much on the news since winning major awards. Most recently The Grocer magazine gave top Grocer Gold awards to our friend Emma Heal MD of Lucky Saint Beer (pictured above) and Olivia Ferdi Co-Founder of CBD drink Trip.

Will these new taxes mean more brewers and wine makers will enter this growing space?